By 7041125677

•

August 15, 2025

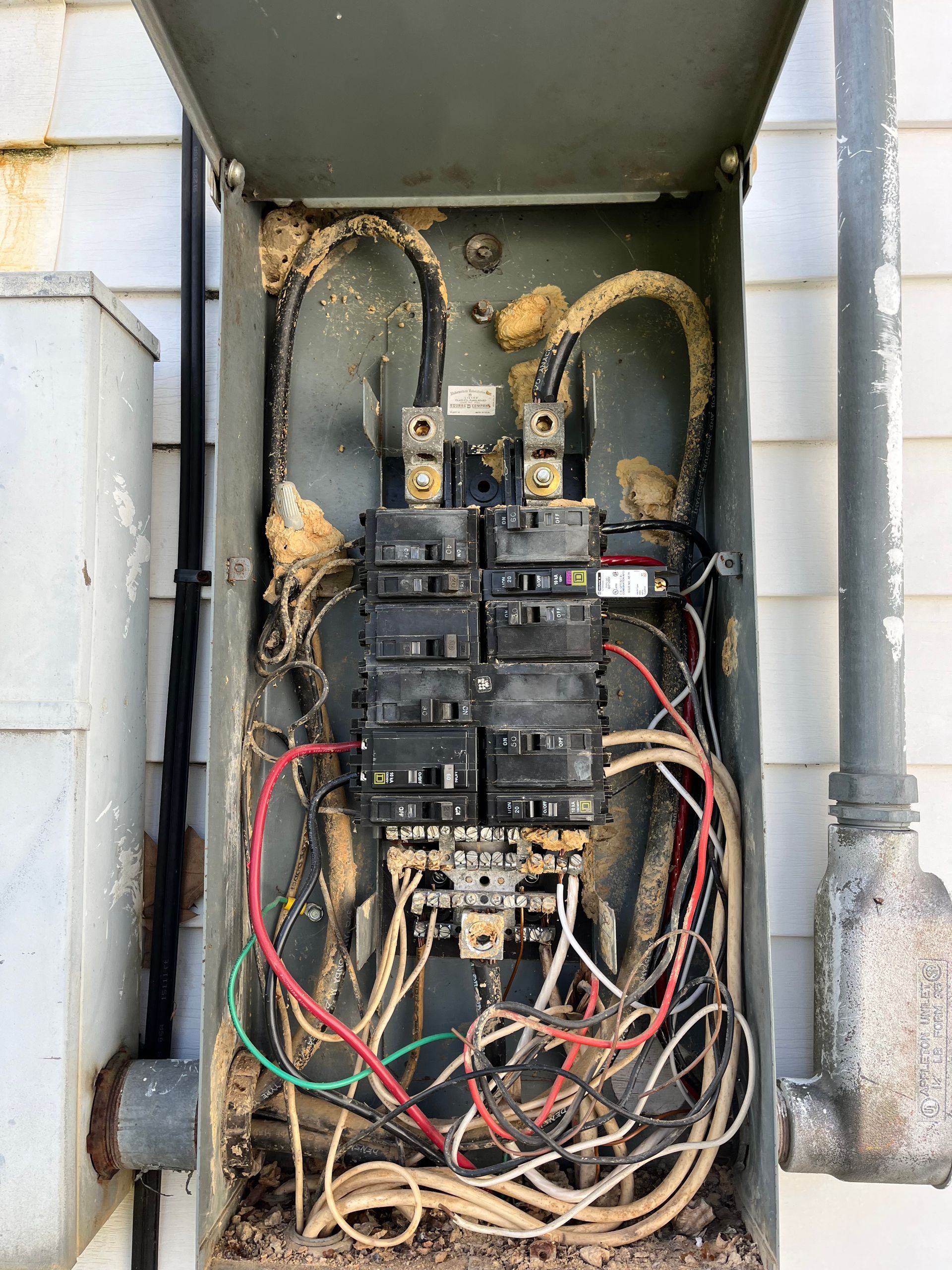

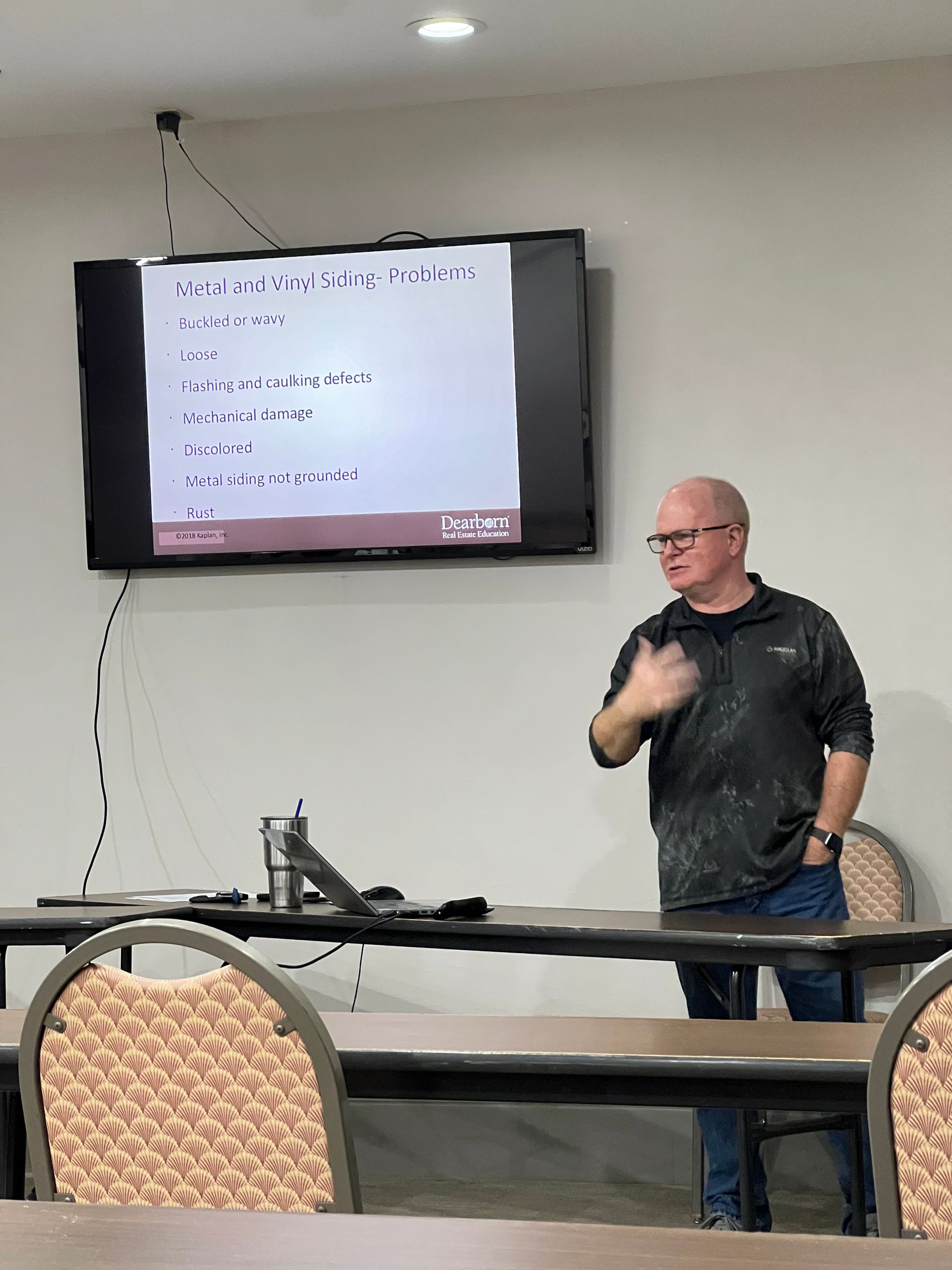

New Arkansas Rule: Home Inspectors Must Carry E&O/Professional Liability (Effective Aug. 5, 2025) On April 22, 2025, Arkansas enacted **Act 974 (HB1625)**, changing the insurance requirement for licensed home inspectors. Instead of general liability being the only mandated coverage, inspectors must now carry **a professional liability (Errors & Omissions, “E&O”) insurance policy** approved by the State Insurance Department, with minimum limits of **\$100,000**. The law takes effect **Tuesday, August 5, 2025**—91 days after the Legislature’s sine die adjournment on May 5, 2025. ([Arkansas Legislature][1], [Mitchell Williams Law][2]) -- Who’s behind the change? Oversight of home inspectors now falls under the **State Board of Appraisers, Abstracters, and Home Inspectors**, created through recent consolidation of real estate-related licensing boards. ([Arkansas Division of Workforce Services][3], [Appraisal Subcommittee][4], [Arkansas Advocate][5]) -- What changed—exactly? **Old rule:** Carry general liability (GL), typically covering bodily injury or property damage during an inspection (e.g., “ladder hits a car”). **New rule (effective Aug. 5, 2025):** Carry **professional liability/E&O** for the **professional services** you provide (e.g., an alleged inspection error or omission that leads to a client’s financial loss). Minimum limit: **\$100,000**. ([Arkansas Legislature][1]) > Practical takeaway: GL protects against accidents; **E&O** protects your **judgment, reporting, and advice**—the core risks of inspecting. -- Why this can raise inspection costs * **Higher premiums than GL:** E&O is usually priced higher than a basic GL policy because the severity of claims (defense + indemnity for alleged errors) can be larger. Trade press and summaries of the act highlight the state’s shift toward more specialized protection for consumers—i.e., E&O. ([Insurance Business][6]) * **Claims-made coverage dynamics:** Most E&O is **claims-made**, meaning current-year pricing reflects industry claims trends and your prior history; tail/retro coverage adds cost. (Industry standard characteristic; check your policy form.) * **Underwriting factors:** Fee levels, services offered (e.g., pools, septic, sewer scope, drones), experience, prior claims, and the counties you serve can move rates. * **Defense costs:** Legal defense often erodes limits unless your policy states otherwise, so carriers price for that exposure. Even modest annual increases in your overhead may need to be reflected in your **inspection fees** to keep margins intact. -How to soften the impact (monthly payments + smart policy design) --- 1) Choose a monthly payment option Most carriers or brokers offer one of the following so you don’t take a big cash hit up front: * **Carrier direct monthly EFT:** A small installment fee, but the simplest option. * **Premium finance agreement:** A third-party finances the annual premium; you pay **monthly** with a finance charge (interest). * **Broker-administered pay plan:** Similar to EFT, sometimes with lower fees if you bundle GL + E&O. Ask specifically: * “Do you offer **12-pay** with autopay?” * “What’s the **APR/finance fee** and any down payment?” * “Any discount for **paperless/autopay**?” These options can spread a \$1,500–\$3,000 annual premium across monthly cash flow instead of one lump sum. --- 2) Tune your coverage to your risk (without going bare) * **Deductible:** If you can absorb small losses, a slightly higher deductible can trim the annual premium. * **Endorsements:** Add only what you need (sewer scope, IR thermography, termite/WDI if applicable, ancillary services you actually sell). * **Appropriate limits:** Meet the state’s **\$100,000** minimum, but consider whether **\$250k or \$500k** fits your job mix and referral partners’ expectations. ([Arkansas Legislature][1]) --- 3) Reduce claims frequency (carriers reward it) * **Crystal-clear scope & contract:** Use plain language about what’s inspected/not inspected; get signatures before you arrive. * **Photographic documentation:** Lots of photos, especially on “no access” or “limited access” areas. * **Report clarity & speed:** Flag “material defects” prominently and send reports promptly to reduce post-closing surprises. * **CE & SOP alignment:** Maintain continuing education and follow Arkansas SOP/administrative rules closely; board-approved CE is available regularly. ([InterNACHI®️ Forum][7]) -- -4) Adjust your pricing—gently and transparently If E&O adds, say, **\$10–\$25 per inspection** to your overhead, consider: * A **small across-the-board fee adjustment**, or * Tiered pricing (age/size/add-ons) that naturally absorbs the cost. Explain to clients and agents that Arkansas now **requires** professional liability/E\&O to better protect consumers—most appreciate the added protection and professionalism. ([Arkansas Legislature][1]) - Key dates & references (so you can cite them in your emails) * **Act 974 (HB1625) approved:** **April 22, 2025**. ([Arkansas Legislature][1]) * **95th General Assembly adjourned sine die:** **May 5, 2025**. ([Arkansas Legislature][8]) * **Default effective date for acts without an emergency clause:** **91st day after sine die** → **Tuesday, Aug. 5, 2025** (per legal summaries referencing the AG’s interpretation). ([JD Supra][9], [Mitchell Williams Law][2]) * **Oversight board:** **State Board of Appraisers, Abstracters, and Home Inspectors** (within the AR Dept. of Labor & Licensing). ([Arkansas Division of Workforce Services][3]) --- -- Bottom line Starting **Aug. 5, 2025**, Arkansas home inspectors must carry **E&O/professional liability** (min. **\$100,000**). Expect some **premium-driven cost pressure**, but you can **smooth cash flow with monthly payments**, tailor coverage intelligently, and make a **modest, well-explained fee update**. It’s a change that elevates consumer protection—and, handled right, it won’t derail your budget. ([Arkansas Legislature][1], [Mitchell Williams Law][2]) If you’d like, I can tailor a short client/agent email announcement and a one-page checklist for comparing E&O quotes. [1]: https://arkleg.state.ar.us/Acts/FTPDocument?ddBienniumSession=2025%2F2025R&file=974.pdf&path=%2FACTS%2F2025R%2FPublic%2F "HB1625 as engrossed on 03-13-2025 10:35:42" [2]: https://www.mitchellwilliamslaw.com/2025-arkansas-insurance-legislation-summary-health?utm_source=chatgpt.com "2025 Arkansas Insurance Legislation Summary: Health" [3]: https://labor.arkansas.gov/licensing/abstracters-board/?utm_source=chatgpt.com "Arkansas Abstracters Board" [4]: https://www.asc.gov/taxonomy/term/21?utm_source=chatgpt.com "AR | ASC gov" [5]: https://arkansasadvocate.com/briefs/arkansas-licensing-board-for-home-inspectors-will-be-combined-with-two-others-under-bill/?utm_source=chatgpt.com "Arkansas licensing board for home inspectors will be combined with ..." [6]: https://www.insurancebusinessmag.com/us/news/professional-liability/arkansas-mandates-eando-or-professional-liability-insurance-for-licensed-home-inspectors-under-hb1625-534681.aspx?utm_source=chatgpt.com "Arkansas mandates E&O or professional liability insurance for ..." [7]: https://forum.nachi.org/t/arkansas-state-board-of-appraisers-abstracters-home-inspectors-approves-internachi-s-webinars-for-live-continuing-education-ce-credits-for-arkansas-licensed-home-inspectors-25-standards-every-inspector-should-know/255277?utm_source=chatgpt.com "Arkansas State Board of Appraisers, Abstracters, & Home Inspectors ..." [8]: https://arkleg.state.ar.us/Home?ddBienniumSession=2025%2F2025R&utm_source=chatgpt.com "Home Page - Arkansas State Legislature" [9]: https://www.jdsupra.com/legalnews/2025-arkansas-insurance-legislation-3186467/?utm_source=chatgpt.com "2025 Arkansas Insurance Legislation Summary: General | JD Supra"

Share On: